Even if a bank has no physical location, it should provide Internet banking using a mobile app. In addition to being practical and easy to use, this service must be extremely secure and adhere to strict privacy requirements. Blockchain technology now excels at ensuring security and protecting data.

As a result, this article will provide instructions for creating a blockchain-based crypto banking software application.

Developing the Concept

This stage is crucial because it helps you understand the kind of crypto banking software you want to build and the measures you need to take to get there.

You must specifically identify the market niche, target market, key features, and the precise use of blockchain.

How to Choose a Blockchain Developer for Crypto Bank Development?

Finding a qualified technical partner is the next step after defining the intended application. Hiring independent contractors or in-house developers to build a blockchain-based internet application is not a good idea. Developing blockchain applications requires specific knowledge and experience, and only a seasoned team can ensure code dependability and protection against illegal access.

The team for your tech partner should be composed of the following specialists:

- Product Director

- One or two back-end developers

- One or two front-end developers

- 1–2 developers for iOS and Android

- 2 to 3 QA Experts

- Enterprise Analyst

- Designer of UI/UX

How to Choose a Software Development Company and the Factors to Consider?

- Creation of Drafts and Prototype

You must then work with your selected developer company to produce a rough draft and prototype of your crypto banking software application. User activities, significant design components, and service functionalities will be described.

The draft should shorten the user’s journey for maximum efficiency, even though it doesn’t necessarily need to concentrate heavily on interface aesthetics.

You can start creating the application’s wireframe once you’ve streamlined the user’s path and determined the crucial design elements. Blocks and lines used in this schematic illustration stand in for various design components and screen navigation for the user.

Wireframes allow for a better knowledge of how the program works, if users can do tasks without interruption, and how simple and convenient it is overall.

The wireframe can be converted into a carefully detailed prototype after you are satisfied and there are no problems or complications. This prototype accurately represents how your finished blockchain-based financial application would look.

- Key Points to Keep in Mind When Creating Your Layout

Make sure all of your design components—colour schemes, icons, buttons, and typography—are cohesive and complement your brand. Each interface element must be specified, understandable, and predictable.

The results of button presses or changes between program displays should be obvious to users on an instinctual level. User expectations should be reflected in the navigation and follow accepted application design standards. Use colours, images, and movies deliberately to arouse desired emotions.

For instance, red causes worry, blue represents trust, and yellow represents innovation and freshness. Be mindful of user perceptions between areas while planning your global outreach.

- Choose the Functions of Crypto Bank

The complexity of the project and the target market will determine the range of features your application supports. The complexity of the project will inevitably increase the scope of the functions.

The choice is between creating a fully functional financial service right away vs starting with a Minimum Viable Product (MVP) and gradually expanding its features.

The following list of features is a must-have for every mobile banking application:

- Account Creation

Users should be able to quickly, safely, and conveniently create an account using their email address, phone number, or social network profiles. This approach must include effortlessly linking bank accounts and cards.

- Account Management

Include options for checking account balances, viewing transaction logs, and switching cards. Users value this information highly. Thus, it should be easy to find from the app’s home screen.

- Payments and Transactions

Although this feature is optional, having it improves user interaction and experience. Implement it with impenetrable safeguards to avoid fraudulent fund transfers. Modern techniques use QR codes and payment connections.

- Finding ATMs and Service Points

The app must locate the user and provide them the way to the closest ATMs, terminals, and service facilities.

- Customer Assistance

The ideal customer support offering combines live specialists for specialized problems with chatbots for frequently asked questions.

- Pop-Up Notifications

Users must know balances, transactions, and app activity adjustments.

What MVP Upgrades Need to Build Crypto Bank?

- Shared Management

Allows users to manage accounts collectively, facilitating group costs for private or professional use.

- Shake to Pay

When devices are close to one another, use a phone’s vibration as a signal to transfer money. Bluetooth or Wi-Fi determines how far away the devices are from one another.

- CVC2 Security

Enhance money security by activating the three-digit CVC2 card verification code’s automatic daily or hourly update with dynamic CVC2.

- 3 Layer Security or Authentication

Use a three-layered security strategy that includes passwords, SMS, voice passwords, fingerprints, or biometric scans.

How to Choose the Best Crypto Platform?

You may choose the best blockchain platform after defining the features of your app and locating the elements needed for blockchain integration.

Though there are certain exceptions, blockchain security and speed are often prioritized. Transaction anonymity and data confidentiality may come first, depending on the app’s goals.

Blockchain networks that are frequently used in banking include:

- Ethereum

This well-liked option, employed by 80% of developers, is excellent for projects emphasizing openness, security, and accessibility.

Equivalent to Ethereum, the Binance Smart Chain stresses tokenization and recently includes license and token/participant certification.

- R3 Corda

R3 Corda is a business network designed by J.P. Morgan specifically for the banking industry that effortlessly interacts with existing crypto banking software.

- Hyperledger

A family of blockchains from the Linux Foundation known as Hyperledger, including Hyperledger Iroha, supports public and private blockchains and is designed specifically for mobile app development.

Choosing the Right Technology Stack

It’s crucial to concentrate on five key factors when selecting a technological stack for building a blockchain application:

- The Back-End

- The Front-End

- Blockchain Integration

- Cross-Platform Compatibility

- Software Reliability/Security

It’s critical to remember to take software dependability and security into account.

Frequently Technologies Used for Such Projects:

- Android: Java, Kotlin, Node JS, ROR (Ruby on Rails), and Laravel.

- iOS: Swift, Node JS, Ruby on Rails, Laravel, and iOS Fabric are supported on iOS.

- Cloud Services: Google Cloud Platform, Microsoft Azure, and Amazon Web Services (AWS).

- Push Notifications: Uing Twilio, Amazon SNS, and MAP (Mobile Application Part).

- Databases: Redis, MongoDB, and MySQL. RSpec, Phantom JS, PUMA server, PhoneGap, C++, and Xcode are additional.

- Blockchain: Depending on the platform selected.

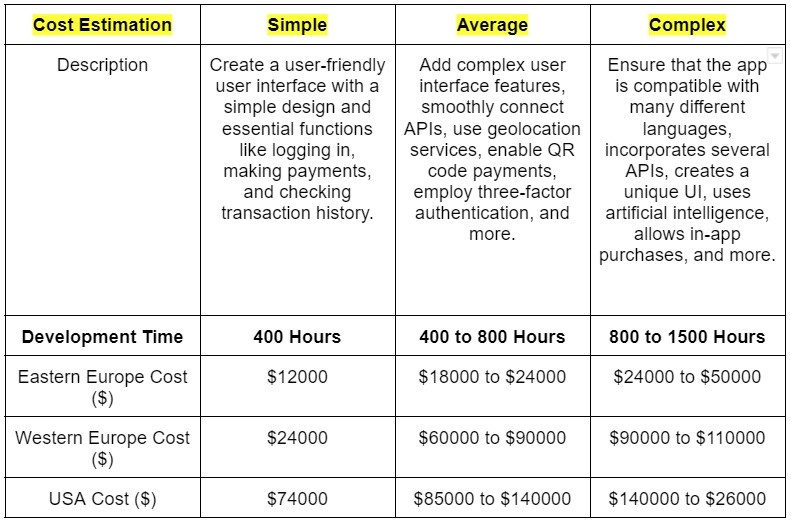

Cost Estimation for Application Development

Currently, programmers are turning your application into code. The developer company’s complexity, functionality, and location affect development costs and schedules. Because developer rates can vary greatly between nations, location is crucial.

Here is a breakdown of the estimated costs for developing a crypto banking software application:

Making Use of Your Solution

After development and thorough testing, you must publish your program to the App Store, Google Play Market, and Microsoft Store. These platforms impose strict requirements for security and reliability. It’s critical to ensure your service functions as intended, is secure from DDoS and hacker attacks and has several anti-phishing safeguards.

Feedback and Continuous Improvement

Launching an app is just the beginning. It’s crucial to collect user opinions and data from your support team continuously. This information helps you remove problems and provide features that align with your target market’s requirements. Additionally, sending the application to the Apple editorial staff for qualified analysis and recommendations is necessary if your emphasis includes users of Apple devices.

Legitimate Matters

Every financial application must abide by the rules and legislation of the nation or nations in which it operates. These laws often include safeguards for user security, privacy, and the fight against corruption, money laundering, and terrorism financing.

Several important financial security laws include:

- Consumer Privacy Act of California (CCPA)

- European Union (EU) and European Economic Area (EEA), the Payment Services Directive (PSD2)

- PCI DSS: Payment Card Industry Data Security Standard

- Canada’s Pan-Canadian Trust Framework (PCTF)

- Adherence to KYC (Know Your Customer) standards

- Europe’s General Data Protection Regulation