Many people consider cryptocurrencies to be a primary store of money, but the notion is much more. Bitcoin is founded in “financial revolt,” not a different means of paying for pizza. There are several advantages to a decentralized, untrustworthy, unchangeable record-keeping and value transfer system. Political and financial leaders worldwide take attention, and you should.

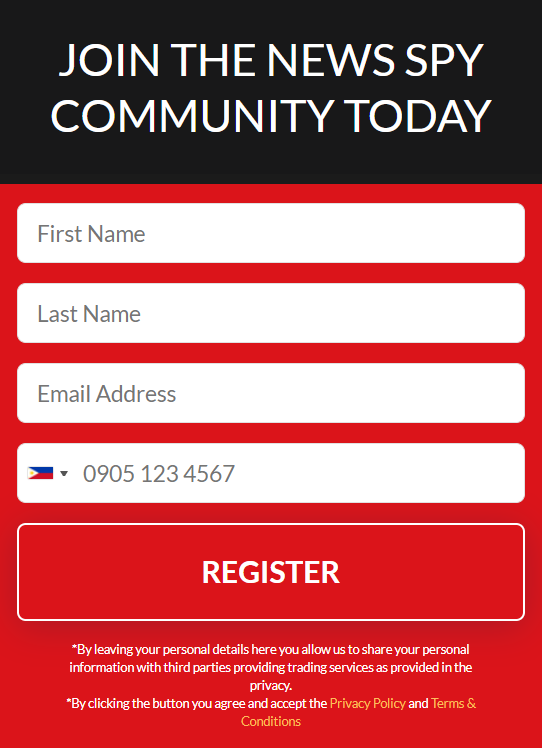

By investing in bitcoin software in 2021, you can become dirty rich. It is hazardous but possibly highly rewarding to invest in crypto assets. Cryptocurrency is an excellent investment if you want direct exposure to digital currency demand, whereas buying stocks of businesses exposed to cryptocurrency is a safer but perhaps less profitable alternative. Click on the image below to start your trading journey. Spy!

Better Structure of Payment

If you’ve ever been upset waiting for a cash transfer from a bank account, you might want to take cryptography. Instant transfers are lower than systems such as Paypal. Using crypto also prevents fraudulent charges as payments cannot be reversed on a blockchain.

You may also send money wherever you choose using crypto without an intermediary examining the history of your transaction. This includes overseas receivers who will gladly save costly money conversion costs from Paypal. Another advantage of adopting cryptocurrencies is the notion of micropayment or payment on demand.

The built-in fees you pay with a credit card will disappear with crypto, making micropayments per second or minute possible. Instead of paying a streaming service membership charge, crypto, for instance, enables you to deliver just while watching a movie.

Transactions

Traditional commercial transactions can lead to substantial complications and expenses for brokers, agents and legal representations in what might otherwise be a primary transaction. Paperwork, brokerage fees, charges and other additional conditions may apply.

One of the advantages of transactions in bitcoin is that they are one-to-one cases in a peer-to-peer networking structure which makes “taking the middle man” a regular practice.

Social Media Decentralized

Facebook and Twitter recently sparked uproar because they were prepared to regulate their platform. There is no central authority in this system responsible for filtering or not censoring contentious information.

Decentralized social media also eliminates the data protection dispute as the central authority for collecting and selling private data is not there. Cryptocurrency micropayments substitute intrusive advertisements as the revenue source for the network. Spam is still undesirable but is controlled by an intelligent contract rather than a mod that can be subjective.

Secure and Safe

Once the crypto-currency transfer is authorized, b2b exchange the charge-back transaction permitted by credit card providers cannot be reversed. This is a safeguard against fraud which requires the purchaser and seller to agree on reimbursements in the case of an error or return.

Finally, the powerful encryption mechanisms used throughout distributed ledger (blockchain) and cryptocurrency operations protect against fraud and bankruptcy and guarantee customer privacy.

Fiscal Stability

Many US investors regard crypto as a volatile investment. Crypto offers a more reliable form of money for a country like Venezuela. Nigeria, Australia, Spain and Canada

In nations like Venezuela, people use Bitcoin literally to save their lives. The government cannot regulate cryptocurrencies almost as much as a fiat currency can. Russia is seeking to build its cryptography and punish any unsubscribed rival.

Individual Property

You effectively transfer the stewardship of your finances in a typical banking or credit card system to a third party that can exercise its life or life authority over your assets. Accounts can be cancelled without notice for violations of the terms of service of the financial institution – requiring you, as the holder of the report, to jump through the hoops to get back into the system.

Perhaps the most significant advantage of cryptocurrencies is that you are the single owner for the corresponding private and public encryption keys, which make up your own identity or address unless you’ve outsourced the maintenance of your wallet to a third party service.

Growth in Investment

Even if you’re not an enormous crypto fan, you probably heard of the Bitcoin frenzy around Christmas 2017. Bitcoin surged in value, reaching over USD 20,000 per coin. It was simply the most acceptable financial investment ever. Since then, Bitcoin’s weight compared to the dollar has decreased, but crypto bulls hope it may improve its performance in 2017 and bring the other crypto market.

This includes highly public crypto-sceptics like Jamie Dimon, Chase’s CEO. The Chicago Mercantile Exchange (CME) offers Bitcoin future options, providing unprecedented market viability before 2017. The crypto market has all the marks of substantial growth potential investments: increased visibility and feeling, comparatively modest market capability compared to established asset classes and constantly expanding usefulness.

Enhanced Access to Loans

Digital data transport and the Internet are media that facilitate cryptocurrency trading. Therefore, these services are theoretically available to anybody with a good Internet connection, understanding the offered cryptocurrency networks, and quick access to the respective websites and portals.

The bitcoin ecosystem has the potential to offer asset transfer and processing to this enormous consumer market — when the requisite infrastructure (digital and regulatory) has been established.

![TamilMV Proxy List Top 30+ [Unblock TamilMV Sites] TamilMV Proxy Unblock](https://technewsgather.com/wp-content/uploads/2023/04/17825836_SL-121019-25870-14-1-100x70.jpg)