The Internet of Things is developing by leaps and bounds and is gradually being introduced into more and more industries. Banking and finance are no exceptions. Analysts predict that the global Internet of Things market in the financial sector will reach $2,030 million by 2023. This is clear evidence that many businesses are investing in both the development of IoT business ideas and technology itself.

This rapid growth is possible because this technology has a large number of applications that can boost the internal processes of many businesses. This is what we will touch upon in this article, namely, the main ways of using the Internet of Things in the financial sector. So, without further ado, let’s get started.

Why Financial Industry Needs Internet of Things

Before introducing something completely new into your business, you must understand what it is for and what you will get in return for your efforts. You must fully understand the benefits of the Internet of Things in this area and its impact on business.

Real-Time Data

This is one of the first ways the Internet of Things can improve financial institutions. Clients will always have access to up-to-date information regardless of their location and the device they use. For example, insurance of real estate or a car requires knowledge of the schemes for the use of the thing that the client wants to insure. Thanks to the Internet of Things, the client can immediately see all the rules and insurance claims that fall under the category and can be covered by a financial institution.

Personal Approach to Each Customer

Clients are unpredictable individuals whose needs are constantly changing and businesses need to adapt to them in order to provide a relevant service of a consistently high level. As a result, the financial sector simply cannot ignore new technologies and must invest in their development and adoption.

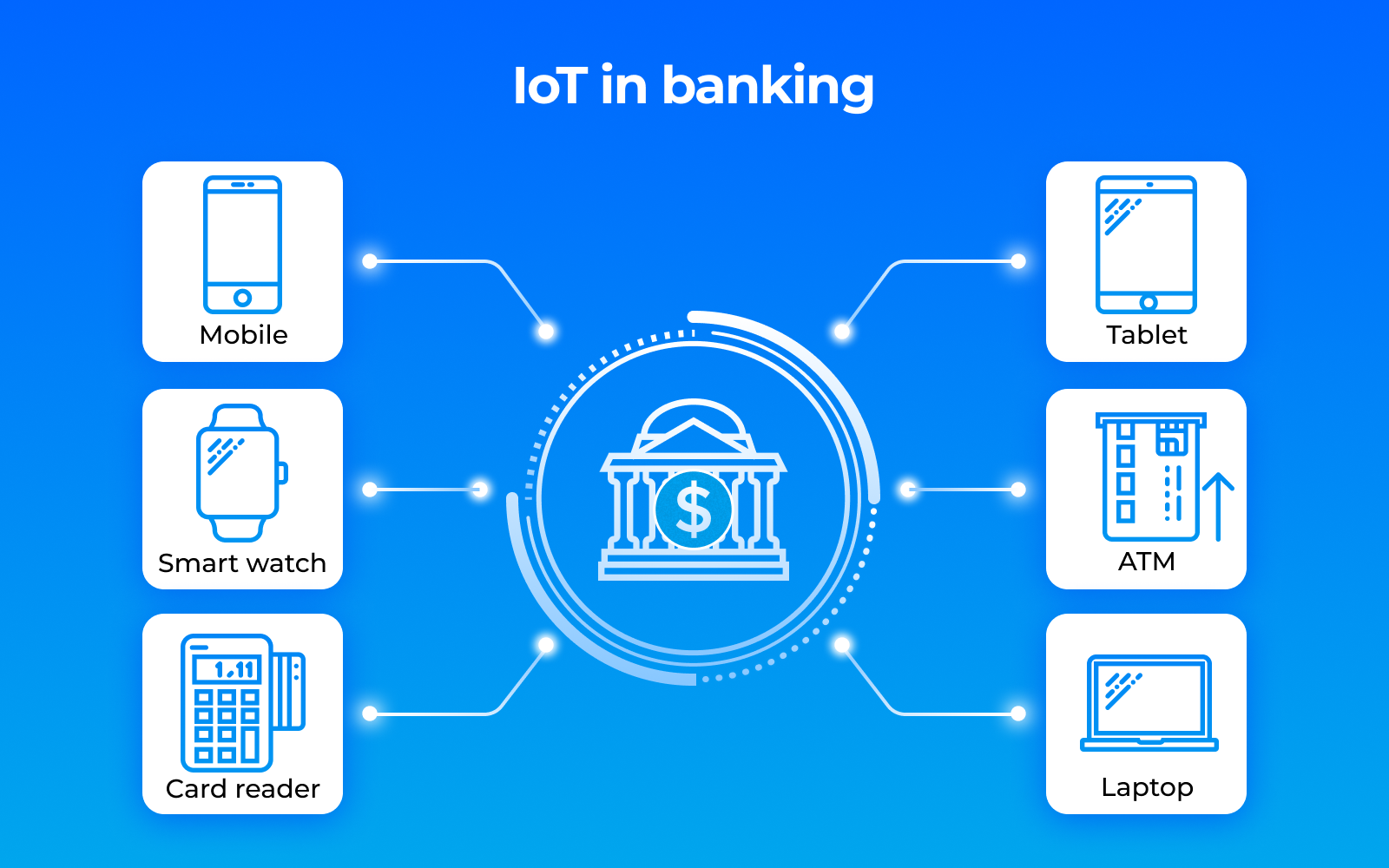

Today it is difficult to find a bank client who would not be able to stay in touch with a financial institution using a tablet, smartphone, or laptop. As a result, banks get a huge field for the implementation of the Internet of Things in order to collect information about customer preferences. This information is extremely valuable, as it underlies business decisions and the development of a personalized approach to each client.

For example, imagine a situation where a customer just walks into a bank. Already at this stage, the Internet of Things starts its work and you can authenticate the client using biometric data and photographs. Next, the customer goes to the ATM. Every Friday the client withdraws the same amount of money using the login through the QR of the banking application. Based on this data, your system can prepare a template that the application will show to the user on Friday and with the exact amount that he usually withdraws. This is just one example of the personalized experience that the Internet of Things can provide.

Better Decision-Making Process

Decision-making is at the heart of the development of any business and all decisions are made on the basis of data. The more there are, the easier it is to come up with new development strategies and the greater their number. The IoT can dramatically improve this process. For example, when developing analytical software, the bank will be able to analyze social networks, purchasing habits, and other indicators that may affect lending to this client in the future. In addition to analyzing individual customers, it becomes easier to analyze entire markets, data that will help make decisions about the feasibility of entering them.

Better Connection Between Devices

Connecting all devices into a single network can help create amazing systems that can improve the financial services provided. For example, it can be a contactless payment combined with a sensor that analyzes what exactly the client wants to pay for. These can be installed at checkouts in supermarkets or any other stores that are gradually moving to a self-service model. Further, this system can automatically connect to the mobile wallet and write off the required amount for purchases after confirming the transaction. This is just one use case and must pass all necessary financial and regulatory compliance checks.

Customer Interaction With IoT

Despite the fact that the Internet of Things has only recently begun to actively penetrate the industry, analysts predict a great future for this technology, namely, the niche of client interaction with various devices. For example, it will be possible to connect your bank accounts to various smartwatches and trackers, which will be able to give signals when the payment limit is exceeded or unauthorized purchases. All these technologies have a lot of development ahead of us, and a lot of interesting things still await us.

Wrapping Up

As you can see, the Internet of Things in the financial sector can provide tremendous opportunities for the development of both the internal processes of financial institutions and the services they provide. The technology is actively developing and will be able to find even more applications in this industry in the future.

Author’s bio:

Yuliya Melnik is a technical writer at Cleveroad. It is a web and mobile app development company in Ukraine. She is passionate about innovative technologies that make the world a better place and loves creating content that evokes vivid emotions.